does instacart take out taxes for employees

What miles can you deduct. Side note Im an idiot who didnt want to pay taxes out of pocket so I canceled 10 Instahours and decided to Instaquit.

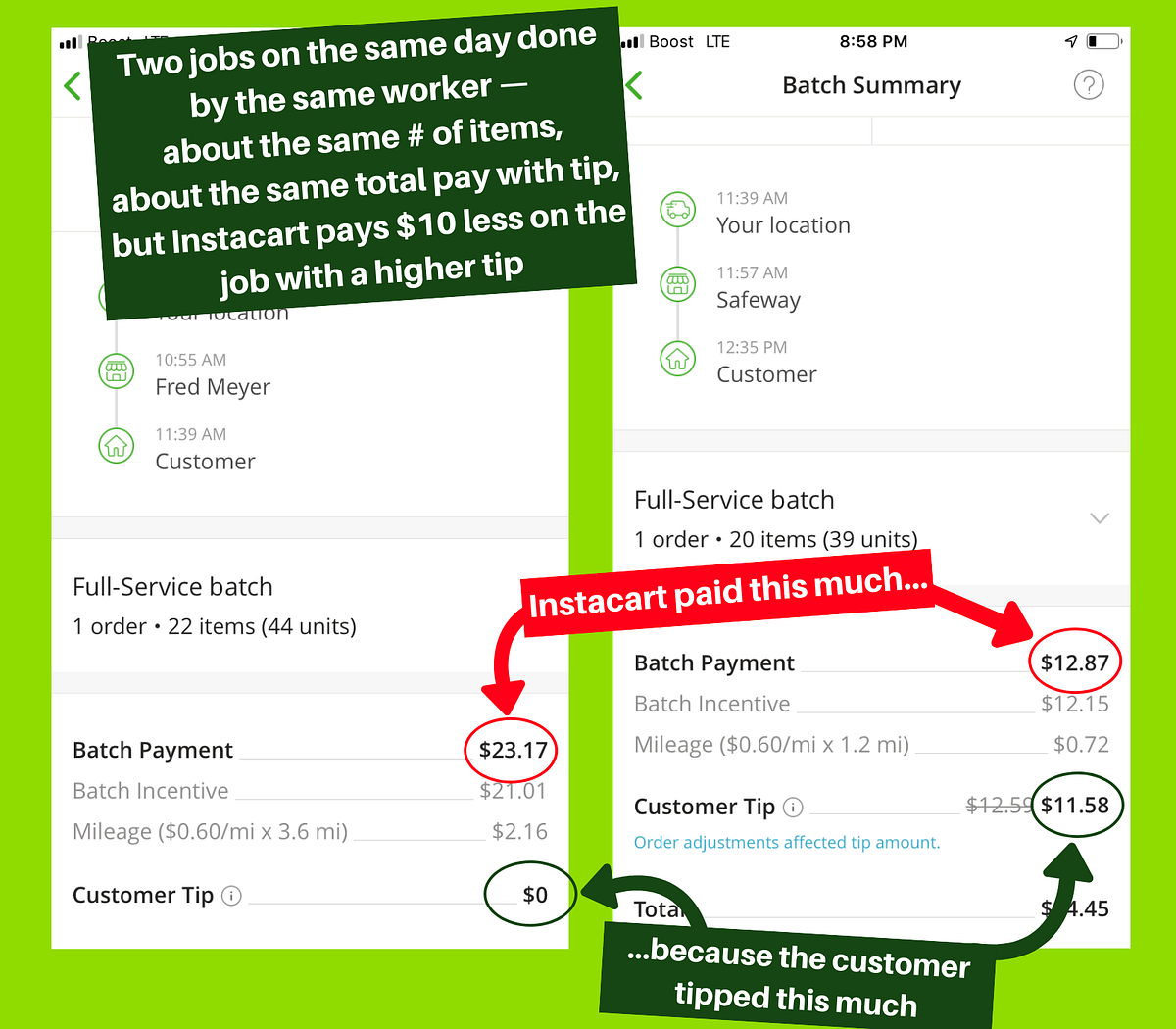

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms By Working Washington Medium

Instacart shoppers use a preloaded payment card when they check out with a customers order.

. Its a lot of money to pay in if youre not ready for it. Yes - in the US everyone who makes income pays taxes. Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season.

Has to pay taxes. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099.

There are a few different taxes involved when you place an order. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099.

Do You Have to Pay Taxes on Instacart. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. Fill out the paperwork.

As an independent contractor you must pay taxes on your Instacart earnings. Except despite everything you have to put aside a portion of the cash you make every week to cover them. What do yall do about taxes.

Get answers to your biggest company questions on Indeed. Instacart does not take out taxes for independent contractors. No minimums to stay working and I sometimes had to go on hiatus.

If you cannot find any good tips its about 7-8 a batch which takes upwards of an hour. Find answers to Do they take out taxes from Instacart employees. The thing is because nothing is withheld from our payments as independent contractors NOW we have to file that and NOW we have to make a payment.

Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season. So if you received a form that means you made over 600 through the app. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour.

Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. Part-time employees sign an offer letter and W-4 tax form. If you drive as a Lyft 1099 contractor for other rideshare apps or do other part-time gigs on the side.

Consequently it is not easy to put any number on Instacarts hourly wage figure. Get more tips on how to file your taxes. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year.

If they make over 600 Instacart is required to send their gross income to the IRS. Register your Instacart payment card. Upload your resume.

They will owe both income and self-employment taxes. You can deduct your business miles. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

Independent contractors have to sign a contractor agreement and W-9 tax form. Does Instacart Take Out Taxes For All Employees. If your net earnings were less than 400 you dont have to report your self-employed income.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. Everybody who makes income in the US. You must report these.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway.

Download the Instacart app or start shopping online now with Instacart to get groceries alcohol home essentials and more delivered to you in as fast as 1 hour or select curbside pickup from your favorite local stores. There is a 45 late fee plus interest for each month your tax return is late but only a 05 late fee for each month your payment is late. Answered September 2 2021 - Personal Grocery Shopper Current Employee - Oroville CA.

If you can find batches with good tips the pay is nice and very flexible hours. This is because the IRS does not require Instacart to issue you a form if the company paid you under 600 in that tax period. Does Instacart take out taxes for its employees.

You should give the company your address so that they can mail you the form to use when you file your taxes. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. As an independent contractor you must pay taxes on your Instacart earnings.

Your self employment tax is your version of Social Security and Medicare taxes that are taken out of a paycheck. Schedule C A Schedule C is the form you will use to report your earnings and losses as a contractor or business owner. No they do not take out taxes that is something that you have to.

Be sure to file separate Schedule C forms for each separate freelance work that you do ie. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. You could work a day making 25 an hour just to get 750 an hour the next day.

Employees have taxes taken out. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. However you still have to file an income tax return.

Should I just save half of my pay. Thats usually all your driving except your house to your first stop and your last stop to back home. Indeed there is a mystery surrounding this as independent employees are at liberty to choose preferred work hours.

The exception is if you accepted an employee position. Instacart has until January 31st to send a 1099-NEC to all shoppers who earned at least 600 in the previous year. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

When you work for instacart youll get a 1099 tax form by the end of january. Heres how it works. To find out additional look at the Complete Guide to Self-Employment Taxes in 2019.

This is a standard tax form for contract workers. This includes self-employment taxes and income taxes.

When Does Instacart Pay Me A Contracted Employee S Guide

Is Working For Instacart Worth It 2022 Hourly Pay Getting Started

Does Instacart Take Out Taxes In 2022 Full Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

When Does Instacart Pay Me The Complete Guide For Gig Workers

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

When Does Instacart Pay Me The Complete Guide For Gig Workers

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

When Does Instacart Pay Me The Complete Guide For Gig Workers

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube